PROCEDURES FOR ESTABLISHING ENTERPRISES WITH FOREIGN INVESTORS

With the current growth rate, Vietnam has become an increasingly attractive country to attract foreign investment in the country. To work together or implement an investment project with a foreign company, the establishment of a new business is the option of many partners. Therefore, in order for customers to have certain knowledge about the establishment of businesses with foreign investors, we would like to provide advice as follows:

1. Prepareation before establishing an enterprise:

First of all, it is necessary to determine the ratio of charter capital that foreign investors hold in an enterprise to determine whether the investor needs to comply with the law for foreign investors.

Clause 1 Article 23 of the Law on Investment 2014 stipulates:

“1. Economic organizations must meet conditions and implement investment procedures according to regulations for foreign investors when investing in the establishment of economic organizations; investment in capital contribution, purchase of shares, capital contribution of economic organizations; BCC contract investment falls into one of the following cases:

a) Having a foreign investor holding 51% or more of its charter capital or having a majority of partners being foreign individuals for economic organizations being partnerships;

b) Having an economic organization defined at Point a of this Clause holding 51% or more of its charter capital;

c) Having foreign investors and economic organizations defined at Point a of this Clause holding 51% or more of their charter capital. “

Based on the above provisions of the law, in case the company cooperates with a foreign enterprise to jointly implement a new project, in which investors hold more than 51% of charter capital, they must follow legal provisions for foreign investors.

Thus, investors must meet the conditions stipulated in Article 22 of the Law on Investment 2014 as follows:• Proportion of ownership of charter capital;

• The form of investment, Vietnamese partners participating in the implementation of investment activities and other conditions in accordance with the international treaties to which the Socialist Republic of Vietnam is a member.

When all of the above conditions are met, the foreign partner cooperating with a domestic company must carry out the procedures for issuance of an Investment Registration Certificate. Regarding the order and procedures for granting investment registration certificates, enterprises should consult whether the project is subject to approval of investment policy. Depending on the project, it will be subject to which authority has the authority to decide which procedure will be conducted according to separate regulations.

After being granted an Investment Registration Certificate, a domestic company and a foreign-owned enterprise can carry out procedures to establish a new enterprise. Regarding the type of enterprise, it is possible to choose to establish it as a limited liability company or a joint stock company.

2. Procedures for establishing a business:

Business registration documents include the following components:

• Request for business registration;

• Company rules;

• List of members (for limited liability companies);

• List of founding shareholders and shareholders are foreign investors (for joint stock companies);

• Valid copies of the following documents:

• Establishment decision, business registration certificate or other equivalent documents of the organization and authorization documents; Citizenship ID card, ID card, Passport or other legal personal identification of authorized representatives of members / founding shareholders and shareholders who are foreign investors are organizations.

(For members / shareholders being foreign organizations, a copy of the business registration certificate or equivalent document must be legalized by the consulate);

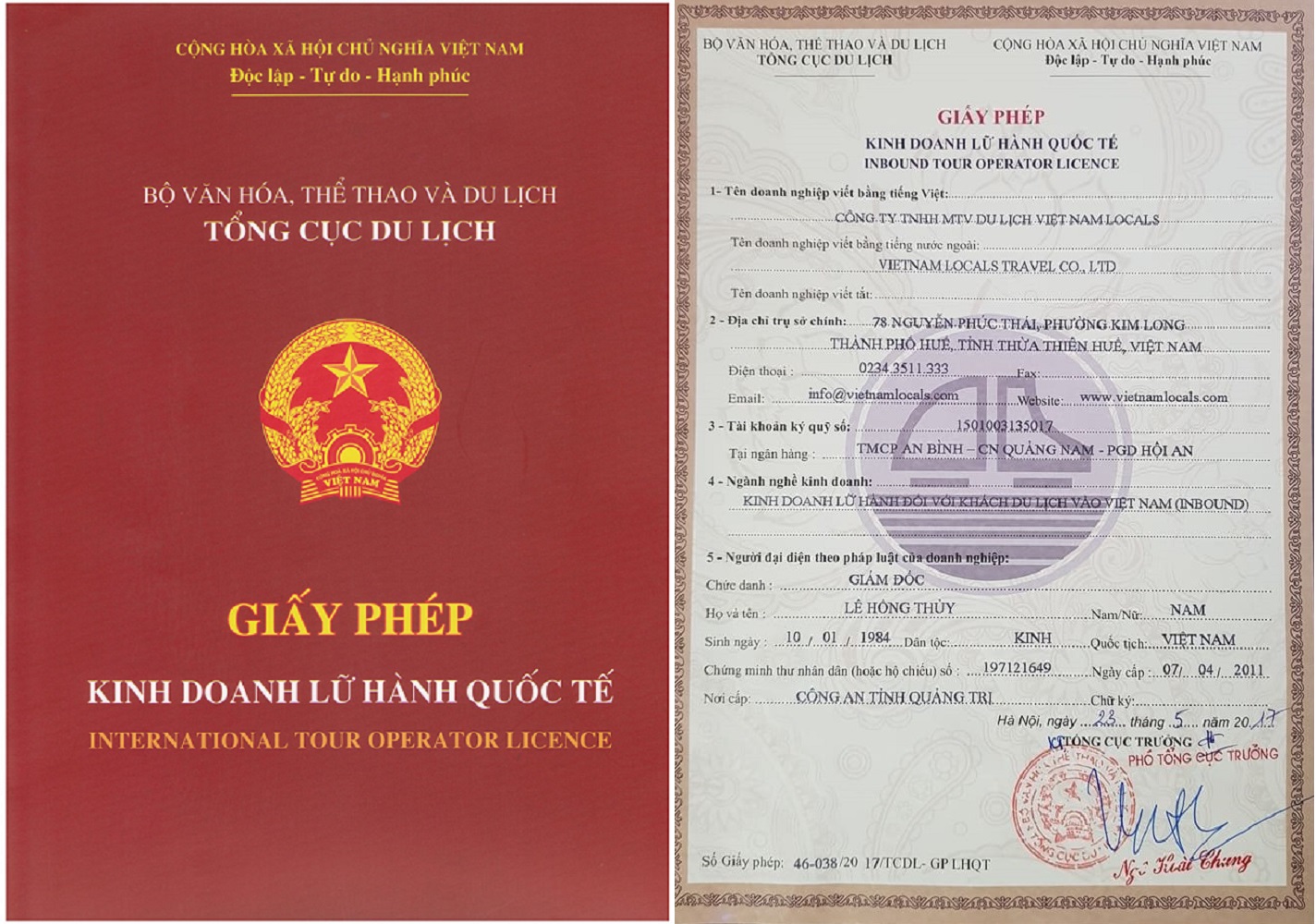

• Investment registration certificate for foreign investors.

The order of execution:

Step 1: The person establishing the business or the authorized person shall submit one set of dossier, including all the above-mentioned components, to the business registration office where the enterprise is headquartered.

Step 2: The business registration office receives the documents, then will consider the validity of the business registration dossier. If the application is valid, the enterprise will be granted a business registration certificate. In case the Business Registration Office refuses to grant the Enterprise Registration Certificate, it must notify in writing the enterprise founder.

Step 3: The legal representative or authorized person receives the results at the Business Registration Office.

Time: 03 working days from the date of receipt of valid documents3. The attached procedures (if necessary):

In case domestic companies contribute capital with assets, the company must carry out procedures to transfer ownership of assets from the company to newly established enterprises.In addition, if a new enterprise is held by a director of a foreign enterprise, he / she must carry out the procedures for applying for a work permit.

If you still have questions or want to use our legal services, you can contact us via the following means:

Vu Nhu Hao and Associates Law Firm

Skype: vu.nhu.hao

E-mail: LawyerVuNhuHao@Gmail.com

Facebook: https: //www.facebook.com/LuatsuNhaTrang

Cellphone: 0914 086292

Address: 16 Mac Dinh Chi street, Phuoc Tien ward, Nha Trang city, Khanh Hoa province